GST/ Tax Based Pricing

You can configure Product pricing entry format to be inclusive or exclusive of tax (GST/VAT/Sales tax). By default the product pricing is exclusive of tax.

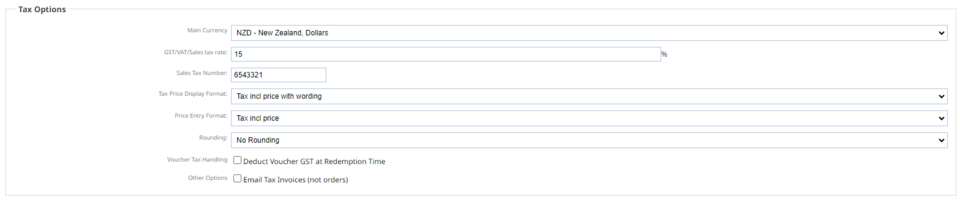

To set tax based price entry in your shopping pages

- Click the E-COMMERCE button from the top menu to give you access to your Catalogue/Shopping cart.

- From the options available, find the Payments and Tax section and click the TAX RATES button.

- Select "Price Entry Format" to "Tax excl price"/"Tax incl price" and click on Save Changes to save the configuration setup.

Tax Price Display Format: is what your customer sees on the website

Price Entry Format: is what you see in the CMS when you add your prices.

Depending on the price entry format choosen, the product label displays Excl or Incl in the configuration pages and the prices are shown accordingly. If no Excl or Incl label is displayed, the price is exclusive of tax.

The price display format in checkout and shopping pages depends on "Tax Price Display format" setup.

Tax exclusive price

When this option is chosen, the tax rate is not included on price entry and the product price is saved as it is. On check out GST is applied on the total order.The example below illustrates the same.

Product Name : Apple

Price Entry Format : Tax excl price

GST:15%

Entry Price (Excl): 2.00 Excl Price : 2.00 Checkout Price : 2.00 + (2.00*15/100)= 2.30

Tax inclusive price

When this option is choosen, the tax rate is included on price entry and the product price less GST is saved.On check out GST is applied on product level to match the inclusive price. The example below illustrates the same.

Product Name : Apple

Price Entry Format : Tax incl price

GST:15%

Entry Price (Incl): 2.00 Excl Price : 1.74 Checkout Price : 1.74 + (1.74*15/100)= 2.00

If the shopping page has multiple currencies, the inclusive price less GST is used for foreign currency checkout.

Price switching

Advanced users can use the "Bulk Pricing" option to adjust product pricing to keep the prices in sync with the new price entry format.